Table of Contents

With Donald Trump’s second term in office, the financial world is set to experience significant changes. His policies are expected to impact stock markets, cryptocurrency trends, and broader economic dynamics. This article explores how Trump’s leadership will shape financial markets, focusing on stocks, Bitcoin, and other cryptocurrencies. We’ll also examine his key financial promises, predictions for economic growth, and the possible changes in financial regulations under his administration.

Trump’s Financial Policies and Their Impact

1. Stock Markets and Wall Street

Trump’s first presidency saw a period of stock market growth, driven by tax cuts, deregulation, and corporate incentives. Investors are hopeful that his return will bring similar, if not more significant, benefits. Trump has always emphasized creating a pro-business environment with reduced corporate taxes, which could stimulate further growth in the stock market.

- Tax Cuts: Trump is likely to continue advocating for tax policies that favor businesses, such as reducing corporate tax rates and providing incentives for companies to repatriate profits.

- Deregulation: Trump’s commitment to reducing government oversight of financial institutions is expected to benefit Wall Street, allowing banks and corporations more freedom to operate without heavy regulatory burdens. This approach could spur innovation and raise stock prices in sectors like banking, technology, and manufacturing.

- Infrastructure Investment: Trump’s promises of massive infrastructure projects could provide a boost to industries related to construction, energy, and materials. These sectors might see a surge in stock values as a result of increased government spending.

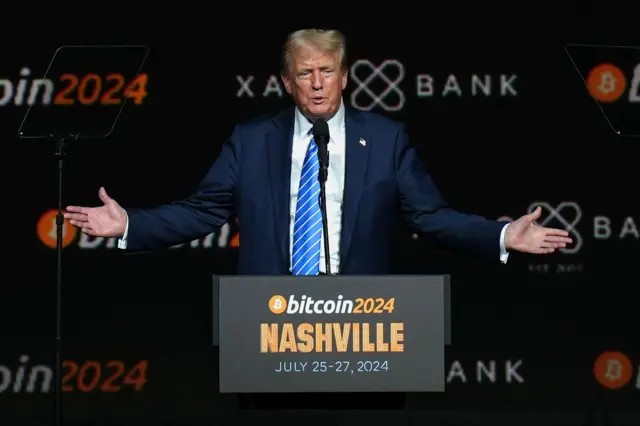

2. Cryptocurrencies and Blockchain Technology

One of the most anticipated aspects of Trump’s financial policies is how they will affect cryptocurrencies like Bitcoin. While Trump has previously expressed skepticism about Bitcoin and other digital currencies, his administration’s stance on regulation and innovation in blockchain technology could lead to significant changes in the market.

- Regulation of Cryptocurrencies: Trump’s administration is likely to adopt a more lenient approach to cryptocurrency regulation, favoring innovation over stringent controls. This could allow for a more free-market-driven cryptocurrency space, encouraging both institutional and retail investors to participate.

- Bitcoin’s Role: Under Trump, Bitcoin could continue to rise as a store of value, especially if inflationary pressures mount. His fiscal policies, such as continued deficit spending and tax cuts, may lead to increased interest in Bitcoin as a hedge against economic uncertainty. If Trump’s government focuses on reducing the dollar’s strength, Bitcoin’s appeal could grow as an alternative currency and a safe haven for global investors.

- Blockchain Innovation: Trump has expressed interest in American technological leadership, and this could extend to blockchain innovation. The U.S. may become a hub for blockchain companies, as regulatory clarity and favorable policies could encourage further development of decentralized finance (DeFi) systems, smart contracts, and other blockchain applications.

3. The Dollar and Global Currency Markets

Trump’s economic policies could influence the strength of the U.S. dollar and its role in global markets. His approach to trade, fiscal spending, and monetary policy will likely have a direct impact on the dollar’s value.

- Dollar Depreciation: Trump has at times expressed a preference for a weaker dollar to stimulate exports. If he pushes for policies that lead to fiscal deficits and increases government debt, the dollar could weaken against other currencies, especially the euro and Chinese yuan.

- Trade Wars and Tariffs: Trump’s stance on trade, particularly with China, could lead to fluctuations in global currency markets. Trade tariffs and sanctions could disrupt global trade flows, affecting currency values and creating volatility in financial markets.

- Interest Rates and Federal Reserve Relations: Trump has frequently criticized the Federal Reserve for raising interest rates and may push for lower rates to stimulate the economy. Lower interest rates could lead to more borrowing and investment, but also affect the global perception of the dollar, potentially leading to higher inflation.

4. Promises for Economic Growth

Trump’s financial promises for the 2024 election campaign revolve around further tax cuts, deregulation, and initiatives to stimulate American manufacturing and industry. These policies are designed to create jobs, boost the economy, and provide a favorable environment for both domestic and international investors.

- Tax Policy: Trump’s promise to cut taxes for individuals and businesses could lead to increased disposable income, higher corporate profits, and an expanded economy. Lower corporate taxes would be especially beneficial for large corporations and could fuel the stock market’s growth.

- Job Creation: Trump has pledged to bring more manufacturing jobs back to the U.S., which could stimulate local economies and improve consumer confidence. His economic policies are likely to focus on providing tax incentives to businesses that expand domestic production.

5. Impact on Emerging Markets and Global Finance

Trump’s policies could have a mixed effect on emerging markets and global finance. While his protectionist trade stance may lead to short-term volatility, his focus on economic growth and deregulation could attract more international investment into the U.S.

- Capital Flows to the U.S.: If Trump’s pro-business policies attract foreign investments into American markets, the U.S. could experience a surge in capital inflows, potentially strengthening the economy and the dollar in the short term.

- Pressure on Global Supply Chains: Trump’s push for reshoring and tariffs could disrupt global supply chains, especially for emerging markets dependent on trade with the U.S. However, countries that align with U.S. interests in sectors like technology and energy may benefit from these policies.

Predictions for the Financial Future Under Trump

1. Stock Market Volatility

Expect periods of high volatility, especially if Trump pursues aggressive trade policies or engages in geopolitical tensions. However, his pro-business stance could drive long-term growth, especially in sectors like technology, finance, and energy.

2. Bitcoin’s Continued Rise

Bitcoin and other cryptocurrencies could continue their upward trajectory as inflation and uncertainty persist. Trump’s fiscal policies might prompt more investors to turn to digital currencies as a store of value and hedge against inflation.

3. Impact on Global Trade

While the U.S. may see short-term gains in manufacturing and job creation, global trade could experience turbulence due to Trump’s trade policies. Emerging markets that rely heavily on exports to the U.S. may face challenges.

Conclusion:

Donald Trump’s second term as President of the United States is poised to create significant changes in the global financial landscape. His policies are expected to have far-reaching effects on stock markets, cryptocurrencies, and the broader economic system. While stock markets may benefit from tax cuts and deregulation, the future of Bitcoin and other cryptocurrencies could be influenced by his approach to regulation and fiscal policy. With a focus on economic growth and protectionist trade measures, Trump’s presidency will shape the future of global finance for years to come.