In a resounding triumph that has left investors exhilarated, Nvidia has shattered all expectations with its recent quarterly report, propelling its shares to a remarkable surge of over 9.5% after hours. The eminent AI chip manufacturer revealed astonishing revenue figures of $13.5 billion for the second quarter, effortlessly eclipsing the projected $11.2 billion forecasted by Refinitiv.

This astonishing feat marks a doubling of their revenue from the same period the previous year, a testament to their unwavering momentum. Their revenue surge, an impressive 90% escalation from the prior quarter, exemplifies the extraordinary trajectory the company is on. Accompanying this revenue surge are earnings that outshine all predictions, with adjusted earnings per share reaching $2.70, compared to the estimated $2.09.

Looking ahead to the third quarter, Nvidia is radiating confidence, projecting revenue to hover around $16 billion, in stark contrast to the predicted $12.6 billion. The company’s foresight and precision in their projections underscore their profound understanding of the industry’s evolving landscape and their remarkable ability to capitalize on its potential.

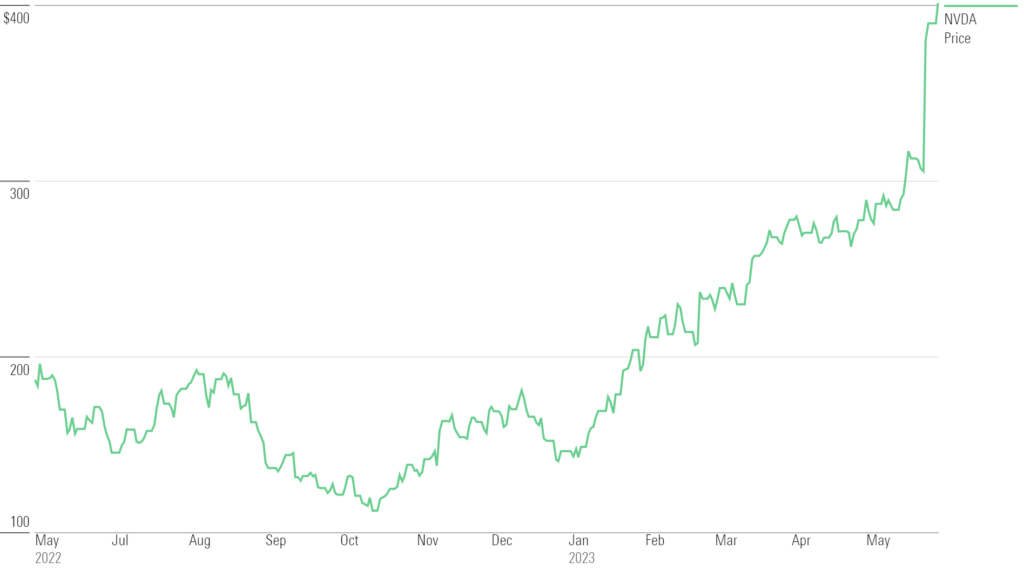

The Nvidia frenzy is far from an isolated event. The company’s meteoric rise has, in fact, played a pivotal role in driving over 10% of the market’s ascent throughout July. Notably, its remarkable gains have taken the lead in fueling the Nasdaq 100’s remarkable 36% rally this year. This captivating narrative is augmented by the realization that Nvidia’s specialized processors are the linchpin behind the prowess of ChatGPT and other generative AI applications.

The technology landscape finds itself in the midst of an AI renaissance, and Nvidia occupies a commanding position at its heart. This enviable position has led to soaring demand for Nvidia’s offerings. The company’s finely-tuned processors have rendered them indispensable in a burgeoning AI ecosystem, driving the fervor and speculation that demand will continue its upward trajectory.

Zooming in on market dynamics, a surge in outstanding call option contracts, a telltale sign of bullish investor sentiment, has come to the fore. This surge has coincided with a flurry of FOMO (Fear Of Missing Out) trades inundating the market, reflecting the palpable excitement and optimism surrounding Nvidia’s future prospects. Curiously, amidst the top 10 companies listed in the S&P 500, Nvidia stands alone as the sole entity where call options command higher prices than put options, indicative of the prevailing confidence in its trajectory.

Industry experts, taking a leaf out of history, liken Nvidia’s exuberance to that once reserved for Tesla. The head of options at Piper Sandler, Danny Kirsch, aptly captures the sentiment, stating, “You can make 10 times your money in a day.” The comparison underscores the electrifying potential that Nvidia’s stocks hold for investors.

However, as Nvidia takes center stage, it must also navigate challenges tied to production capacity. Demand for their AI chips is robust, but the pace at which Nvidia can manufacture them will be the pivotal factor. The implications of any supply constraints will reverberate across the tech landscape, impacting companies reliant on Nvidia’s chips to fuel their own products and services. The recent example of Supermicro’s comments and the subsequent stock price fluctuations serves as a cautionary tale, underscoring the interconnectivity of the tech ecosystem.

In closing, Nvidia’s triumphant second-quarter performance stands as a beacon in the tech industry, signaling the rise of AI’s prominence. Their unparalleled growth defies expectations and propels them further as a driving force in shaping the future. As they continue to innovate and expand their capabilities, the world watches with bated breath, eagerly anticipating the next chapter in Nvidia’s remarkable journey.