Table of Contents

What is crypto in simple words?

Cryptocurrency is digital money that exists on the Internet. Many people want to learn how to make money from them, but sometimes it can be difficult. Here are some simple steps for those just starting out:

- What is cryptocurrency?

Cryptocurrency is digital or virtual money that uses encryption technology for secure online transactions. Examples include Bitcoin and Ethereum. - How to start trading cryptocurrency?

First, you need to create an account on a cryptocurrency exchange. On such platforms, you can buy or sell cryptocurrency, similar to how you exchange dollars for euros. - Risks of Cryptocurrency Trading

Cryptocurrency trading can be risky due to price volatility. Prices can change quickly and investors may lose money. - Trading with bots

Bots are programs that automatically trade your money on the exchange. Using a bot can help reduce risks as it monitors the market and makes decisions based on predefined rules. - How to Avoid Losses

To avoid big losses, it is important to use the bot with caution and customize it to suit your financial goals. You also shouldn’t invest more money than you can afford to lose. - Constant learning

The cryptocurrency market is constantly changing, so it is important to constantly educate yourself and stay up to date. This will help you make more informed decisions when trading.

What are spot and futures in simple words? Explanation of terms.

Futures Trading and Spot Trading:

Futures trading:

- Definition: Futures contracts are agreements to buy or sell an asset (such as a cryptocurrency) in the future at a specific price.

- Advantages:

- Allows investors to protect their assets from market volatility.

- Provides the ability to use leverage (borrowing to increase investments).

- Risks:

- Market volatility can lead to large losses.

Spot trading:

- Definition: Spot trading is the purchase or sale of an asset for immediate delivery and payment.

- Advantages:

- Simplicity and straightforwardness of transactions.

- Does not require additional contracts or future obligations.

- Risks:

- The investor is exposed to the current market price of the asset.

Other terms:

Grid bot:

- Definition: Grid bot is a trading bot that places buy and sell orders in a certain price range (creates a grid of orders). This allows you to automatically make money on price fluctuations.

Long and Short:

- Long: A position in which an investor buys an asset in hopes of growth in order to sell it in the future for a profit.

- Short: A position in which an investor sells an asset with the intention of buying it back at a lower price in the future.

APR (Annual Percentage Rate):

- Definition: An annual percentage rate used to express the cost of borrowing or the return on an investment for a year.

Market volatility:

- Definition: A measure of price volatility in a market. High volatility means large price swings, which can be both an opportunity and a risk.

Leverage:

- Definition: The use of borrowed funds to increase the size of an investment. Increases both potential profits and potential losses.

Why is it safest to invest in Lending?

Investing in Lending on platforms such as (Get Now 10USDT for Registration and Card from) Bybit or (Get Up to 100USDT in Compensation on) Binance may be considered relatively less risky compared to some other types of investments, but also has its own features and risks. In Lending, you lend your funds to other users or trading bots, and receive interest as income. Here are a few factors to consider:

Low income:

- Income from Lending tends to be more stable, but also lower compared to other forms of investment, such as cryptocurrency trading.

- It is important to realize that the expected profit may be relatively low.

Amount of investment:

- The investment amount depends on your financial situation, risk tolerance and financial goals.

- It is better to start with the amount you are willing to lose and gradually increase based on your experience and confidence in the chosen platform.

Platform selection:

- Different exchanges provide different conditions for Lending. It is important to study the terms, rates and security ratings of the platform before investing.

Risks:

- Any form of investment involves risks. In Lending, risks may include non-repayment of loans, market unpredictability and loss of liquidity but the probability of this is 1%.

Diversification:

- Consider diversification, that is, spreading your investments among different cryptocurrencies or loans, to reduce your overall risk.

Before investing, it is important to conduct thorough research and understand all aspects of the Lending platform you choose. It is also recommended to start with small amounts to evaluate the performance of the system and your confidence in the process. Try to follow the principle “don’t invest more than you are willing to lose.” These examples concern

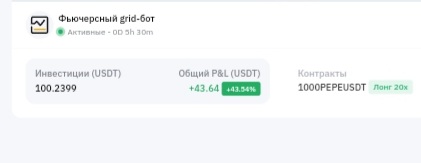

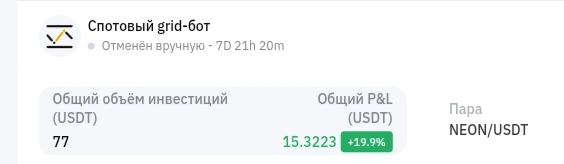

Here are examples of futures and spot bot trading

Let’s look at an example of investing in cryptocurrency futures and spot. Let’s say you have $1,000 and are considering investing in Bitcoin.

1. Futures trading:

- Investment Amount: Let’s say you decide to take a Bitcoin futures contract worth $1,000.

- Leverage: Let’s say you use 5x leverage, which allows you to control a $5,000 position.

- Market Movement: If the price of Bitcoin rises by 5%, your leveraged profit will be $250 (5% of 5000).

- Risks: However, with leverage comes increased risk. If the market goes down, you may also lose more.

2. Spot trading:

- Investment Amount: You decide to buy $1,000 worth of Bitcoin without using leverage.

- Market Movement: If the price of Bitcoin rises by 5%, your profit will be $50 (5% of 1000).

- Risks: Risks are limited to the amount of your initial investment and you do not face additional risks associated with leverage.

Summary:

- Leveraged futures trading can increase your profits, but it also increases your risk of loss.

- Spot trading is more conservative and without the use of leverage has lower risks but also potential profits.

The choice between futures and spots depends on your financial goals, risk tolerance, and trading experience. It is also important to remember that all trading involves risks and should be undertaken with caution and in accordance with your financial situation.